.png?v=v1)

.png?v=v1)

2022.12.16

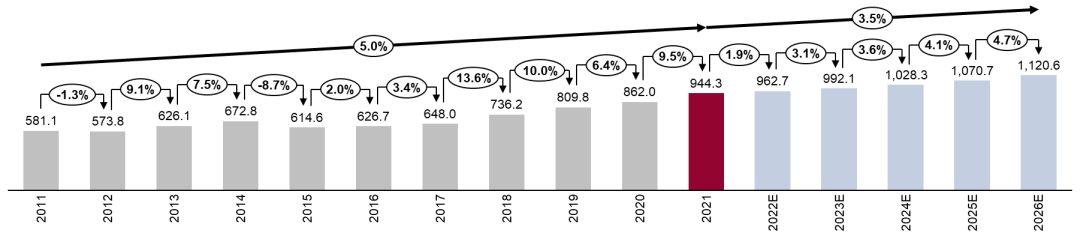

Low voltage electrical products are widely used in the fields of construction, industry and infrastructure. Affected by the investment, construction and commencement of downstream industries, the low-voltage electrical appliances market is cyclical and volatile.

In 2021, due to the impact of the project delay in 2020 and the increased investment in the infrastructure industry, the domestic low-voltage electrical market will grow at a high rate of 9.5% year-on-year. In 2022, due to multiple factors such as repeated regional epidemics, slowing industrial recovery, downward construction, and poor international market environment, the low-voltage electrical market will have a bad start and enter a low growth period. The annual growth rate is expected to be about 1.9%.

China's low-voltage electrical market scale - 2011-2026E

(100 million yuan)

The 2022 low-voltage white paper was completed in early June. The 2022 forecast is based on the judgment at the beginning of the year. The overall business forecast is slightly increased, which is optimistic. It is now observed that due to the continuous impact of the epidemic in the second half of the year, the real estate downturn has increased. It is estimated that the market growth in 2022 will be slightly negative, about - 3~- 5%.

It is estimated that after 2022, with the increase of investment in data center, new energy (photovoltaic, etc.), communication and other fields, it will become the main growth pole of low-voltage electrical market; The industry has entered the recovery cycle and is expected to maintain a medium high speed and stable growth during the "Fourteenth Five Year Plan" period; In the construction sector, the growth rate of market investment has declined due to the financial situation of real estate developers.

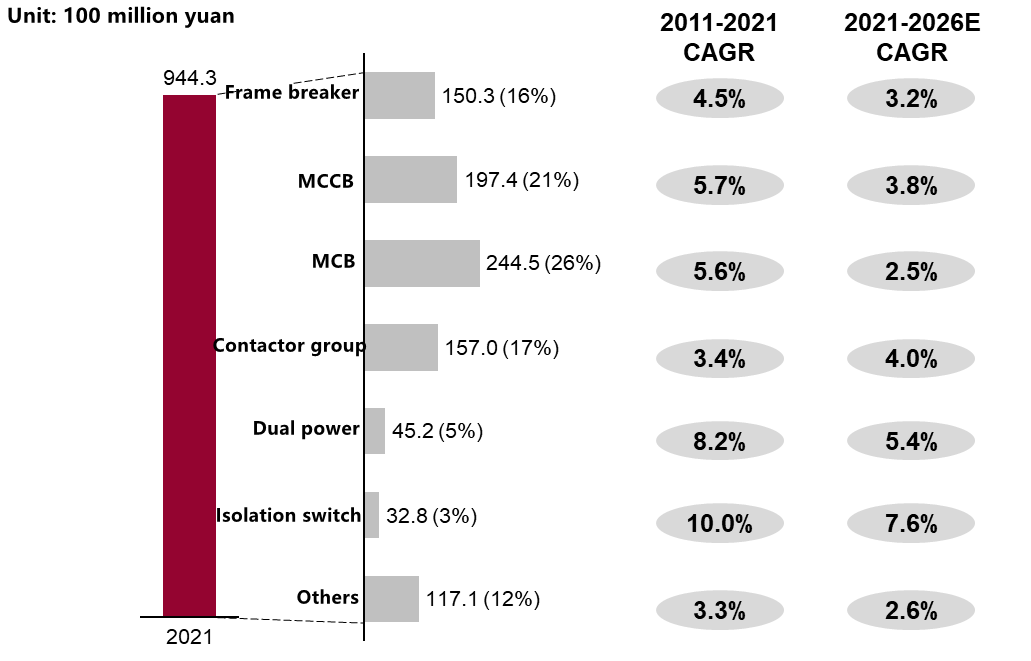

1. China's low-voltage electrical market scale - product segmentation

Segmented product application fields:

The main products of low-voltage electrical products are three disconnection and one connection, accounting for about 80% of the overall low-voltage electrical products

The framework is mainly used in the fields of architecture, wind power, infrastructure, etc.

The application of plastic shell products in downstream industries is relatively average, with construction and industry as the main industries.

The application of miniature circuit breakers relies on the construction field, has a wide audience scene, and has the largest market volume, accounting for about 26% in the low-voltage electrical appliances market.

The contactor group industry is concentrated in industrial OEM and has strong correlation with factory automation.

Product segmentation of low-voltage electrical market scale in 2021

(Industrial projects)

Forecast of future trend of subdivided products: there is a strong positive correlation between the growth of disconnectors and dual power supplies and the new energy of buildings, infrastructure and power grids. During the "14th Five-Year Plan" period, the state continued to increase investment in infrastructure and new energy industries, which will drive the performance of disconnectors, dual power supplies and other products to continue to grow steadily. The volume of micro-break products accounts for a large proportion, but due to the greater impact of real estate macro factors, the growth rate has slowed down.

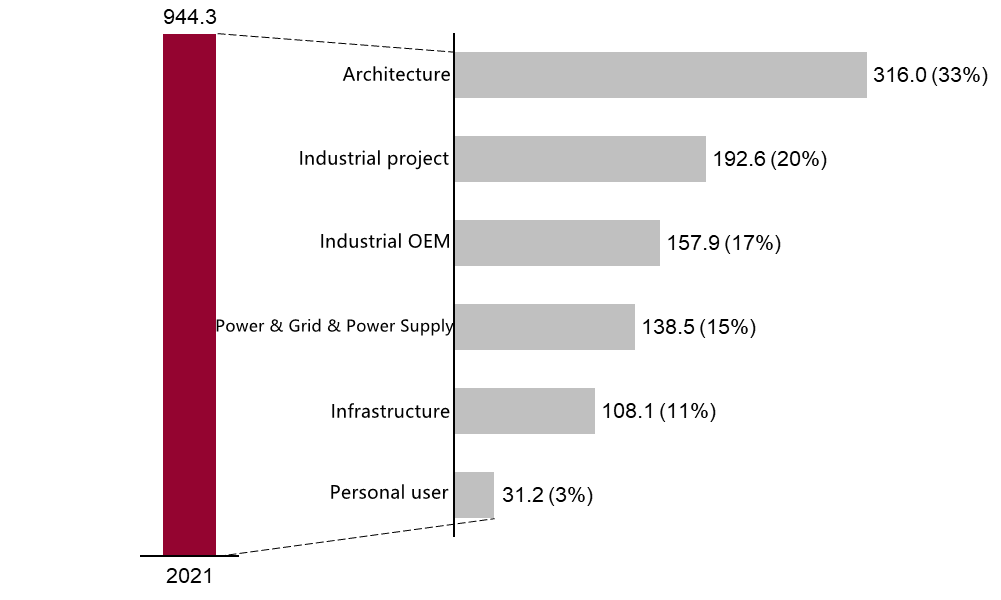

2. China's low-voltage electrical market scale - user industry segmentation

In 2021, construction and industrial projects will account for a large proportion in the overall low-voltage electrical market, accounting for more than 50% in total. In 2021, the growth of public construction and commercial construction will slow down, and the financial problems of private construction real estate developers will occur frequently, resulting in a decline in the performance of the construction industry and a decline of 4.5 percentage points in the market share.

China's low-voltage electrical market scale User industry segmentation - 2021

(100 million yuan)

From the perspective of the market, infrastructure and power grids have grown steadily, and investment in industrial projects and industrial OEMs has increased rapidly. The personal user industry is mainly related to purchasing power and purchasing behavior. With the increase of household load applications, the future growth rate will be slightly higher than that of the market. The country's macro-control in the field of construction, the future market growth rate is relatively weak.

In the field of industry segmentation, the main growth points of infrastructure are data center, communication, subway, hospital, municipal and other industries. Among industrial projects, consumer electronics, packaging, food and beverage and other light industries develop rapidly, while metallurgy, petrochemical, chemical, steel and other industries develop relatively slowly, but there are many opportunities for transformation and double carbon energy saving. Real estate growth has entered a period of integration, real estate companies are under greater cost pressure, and the trend of localization of low-voltage components is obvious.

The industrial OEM market is fragmented. People's livelihood fields such as elevators, HAVC, and packaging are developing well, while market segments such as port machinery and hoisting machinery are performing moderately. In the power grid industry, hydrogen energy is initially commercialized, and the market has begun to take shape; the new energy industry (photovoltaic, wind power) maintained a good momentum of development; The performance of traditional power generation field is general, lacking strong growth points; Energy storage is favorable for the integration of optical, storage and charging, and has maintained a rapid growth.

Copyright © 2019.Company Name All Rights Reserved.